Simple Budget Spreadsheet, Google Sheets Budget Template.

This beginner friendly Google Sheets template simplyfies the way you handle your finances, manage your income, bills, expenses savings and debt payments all within one comprehensive tab.

Whether you prefer a Monthly Budget Spreadsheet, a Weekly Paycheck Budget, or a Biweekly Budget, our versatile template adapts to your needs seamlessly.

IMPORTANT !This spreadsheet is only compatible with Google Sheets, not with Excel / Numbers!

OTHER SPREADSHEETS:

Expense Tracker: Monthly Budget Calendar: Neutral Simple Budget: 50/30/20 Budget: !This spreadsheet is only compatible with Google Sheets, not with Excel / Numbers!

Key Features:

Easy Setup Guide: Get started quickly with our intuitive setup guide included right within the Budget Template. Say goodbye to confusion and hello to financial clarity.

Customizable Periods: Whether you’re budgeting monthly, bi-weekly, or aligning with your paycheck schedule, our template accommodates your preferences effortlessly.

Income Tracking: Monitor your income sources and watch as the Budget Spreadsheet Excel automatically calculates your total income, providing you with a clear picture of your financial inflow.

Expense Management: Keep your spending in check with our Fixed Bills & Expenses Tracker tables. Categorize expenses, track monthly expenses, and ensure you stay within your budget limits.

Savings & Debt Payoff Tracking: Set ambitious savings goals and track your progress with our Personal Finance Dashboard. Monitor debt payoff effortlessly, keeping you motivated on your journey to financial freedom.

Dynamic Visual Charts: Visualize your expenses breakdown through dynamic charts, offering an intuitive snapshot of your financial habits. Identify trends and areas for improvement at a glance.

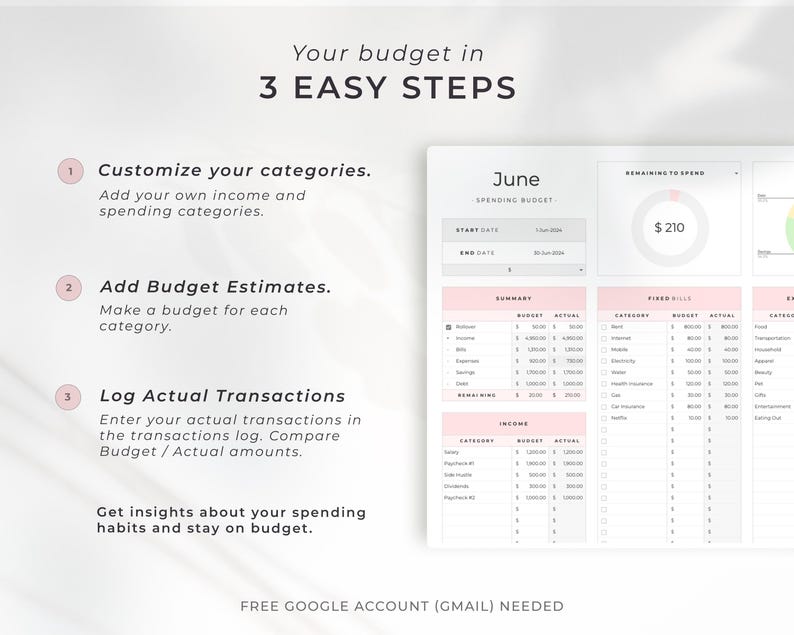

Step-by-Step Guide to Creating and Managing a Personal Budget

1- Create Your Categories

Start by identifying all the categories that will encompass your financial transactions. Common categories include:

– Income: Salary, bonuses, freelance income, etc.

– Bills: Rent/mortgage, utilities, phone, internet, etc.

– Expenses: Groceries, dining out, entertainment, transportation, etc.

– Savings: Emergency fund, retirement savings, investments, etc.

– Debt: Credit card payments, student loans, personal loans, etc.

2. Input Your Income Estimates

Estimate your monthly income from all sources. This could include:

– Primary Job: Your regular salary or wages.

– Secondary Job: Any additional part-time job or freelance work.

– Other Income: Interest, dividends, gifts, etc.

3. Distribute the Income through Your Bills, Expenses, Savings, and Debt Categories

Allocate your estimated income to different categories based on your financial goals and obligations.

4. Input Your Transactions into the Log Table

Keep track of all your financial transactions by recording them in a log table. Select date, category, subcategory and input the amount.

As you input your transactions, your budget vs. actual flow will update automatically, allowing you to see where you stand relative to your budget.

5. Adjust Your Budget as You Go

Regularly review your budget and actual spending to make necessary adjustments. This might involve:

– Reallocating funds between categories if you consistently overspend or underspend in certain areas.

– Adjusting your savings and debt repayment goals based on changes in your income or expenses.

– Making strategic decisions about discretionary spending to stay within your budget.

6. Final Tips

– Review your budget weekly or bi-weekly to stay on track.

– Set realistic financial goals and adjust your budget to meet those goals.

– Be disciplined with your spending and mindful of your financial habits.

Our Paycheck Budget Template simplifies budgeting, empowering you to take control of your finances with ease. Whether you’re a novice or a seasoned budgeter, our template provides the tools you need to succeed. Say hello to effective budgeting with our Budget Planner today!

FEATURES:

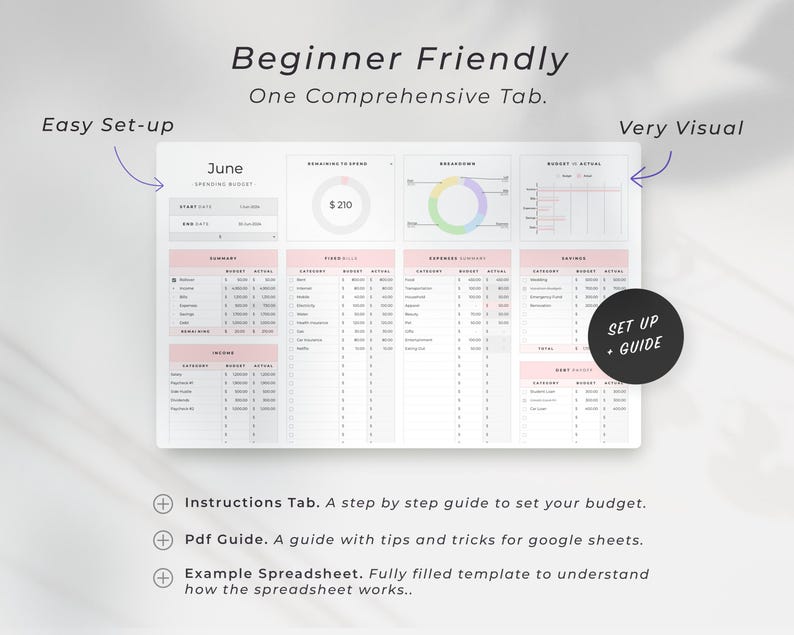

Beginner Friendly.

Set Up guide.

Comprehensive One Tab with the budgeting essentials.

Multiple budget periods, just duplicate the Budget tab.

Works with any currency.

Customizable categories.

Sync the spreadsheet across multiple devices.

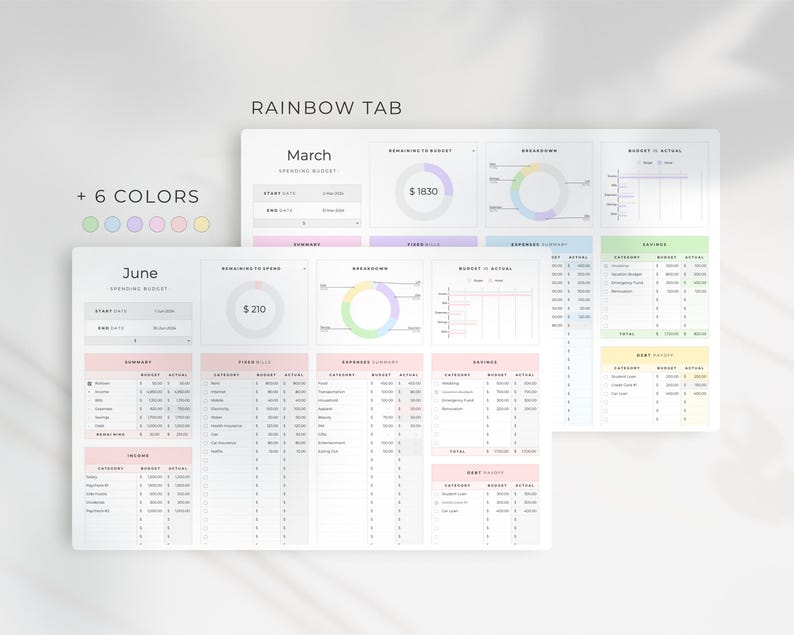

Visual Overview with Automatic Charts.

budget vs actual graph

left to spend graph

Expense tracker

Expense breakdown

Checkboxes to mark paid bills

FILES INCLUDED:

A PDF with a link to the spreadsheet template.

A 20 Pages PDF with instructions, troubleshooting solutions, helpful tips, and all the information you need to optimize your planning experience.

YOU WILL NEED:

A device to access Google Sheets.

A Free Google Account (Gmail).

Basic computer knowledge.

HOW TO ACCESS THE TEMPLATE:

1. Purchase the template.

2. Receive a mail to access your purchase ( Download the pdf with the link to your spreadsheet (Do it on the computer or mobile browser as files are not available on the app).

4. Access the template and start planning.

More info on digital downloads and how to access them in Etsys help centre Please note that this is a digital download and does not include physical product //

//The financial templates and tools dont constitute financial advice or a recommendation. The mock text and the images are intended as examples of usage and informational purposes only, and users should seek professional advice before acting on it. //

//For personal use only, this item cannot be resold, redistributed, or used for any commercial purposes//

If you have any questions dont hesitate to contact me through direct message. Im always happy to help. CoranoteCo

Jas –

The tracker is easy to use. The owner provided tutorial. Colorful and organized.

Marcy –

It is very user-friendly and has lots of great functions. Thank you for putting this together.

Samuel –

item was great great great

Bam –

Thank you! Does exactly what it was meant to do.